What happened in Q3 of 2023

Q3 continued to be lethargic with a slight uptick in activity after the intense summer heat. The higher-end and mid-tier bands experienced further material softening while the entry level started seeing a leveling off on price depreciation. The stand-off between Buyers holding out for better rates or better pricing and Sellers not willing to go much further on pricing came into focus to the backdrop of closings volume seeing a slight uptick compared to Q2.

Naturally, the market experienced additional softening bringing us to 7% depreciation for the year by the end of September but about on track for what we forecasted.

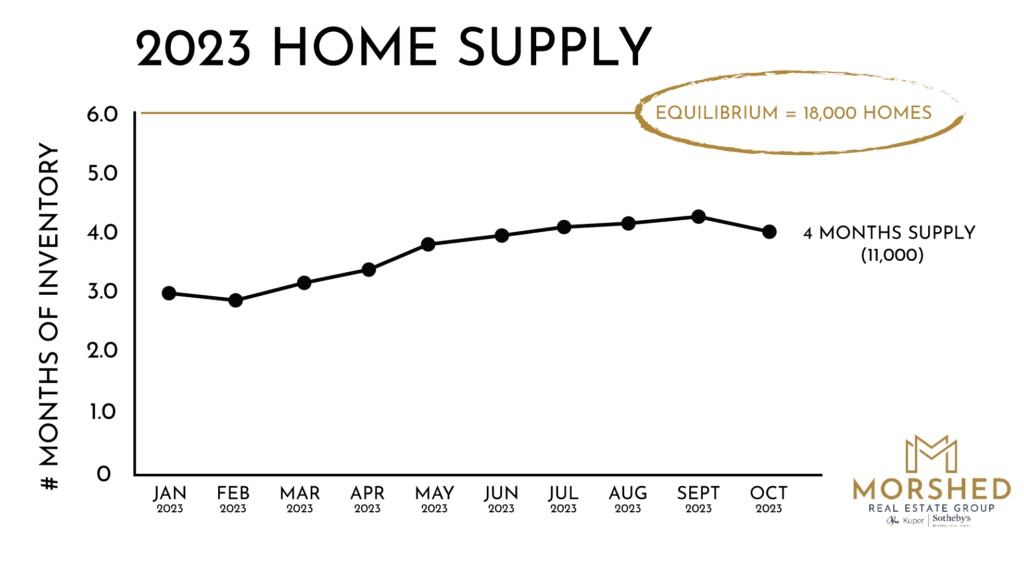

Supply of housing remained the same as end of Q2 at 4 months. At that supply point, we are in a real estate market environment that is still undersupplied. For context, a 6-month supply (or about 18,000 homes available), is an equilibrium market between Buyer and Seller demand and we would normally see 4-6% annually in price rises. At 4 months supply, there are about 11k homes on the market, so still well below 18k homes or above.

Finally, the job market in Austin continued to hold stronger than expected leading to #7 ranking nationally. While Buyers still gated buying due to rising rates, this is big news. Austin is on pace to add 40k jobs this year and the unemployment rate decreased from 3.8% to 3.3%. So while Buyers are still waiting things out due to high interest rates, pent-up demand in the market is real.

Of note, there were 11k home this time last year (a 4 month supply) and its the same one year later yet prices have dropped an additional 7% due to high rates stopping Buyers. Once rates drop, and given our job market fundamentals, we believe things will shift quickly with pent-up demand and supply holding low.

Currently and where it’s going

In Q4, Buyers are continuing the wait for amazing value before they purchase. While Q4 is typically slower, this year is markedly slower. The homes selling are ones priced well below market value. With Sellers being buoyed by lack of inventory as well as not wanting to give much more it’s creating a stalemate…a showdown of sorts to see who buckles first.

We’ve hit bottom and we feel prices may drop 2-4% further if that, so we’re pretty much at the soft landing we forecasted. In Q2 we forecasted rates would start moving down slowly in December which they have. Until they move down to the 6-6.5% range, Buyers will be patient so we’re expecting a slow but bottoming out Q1 2024. By eo Q2 2024 we think rates will move down further and the market will be poised for appreciation on the back half of 2024 given lower supply and stable job market as well as steady population growth. This is stark contradiction to articles by the likes of Mansion Global predicting 12% depreciation for Austin in 2024. We feel confident in our forecasting.

For Sellers

For Sellers, you’re going to feel the pain of value seekers till rates lower through this quarter. To sell you’ll have to leave equity on the table. Homes that are fully turnkey with pricing that sets it apart from the competition is what will sell. Otherwise you’re better off waiting till middle of 2024

For Buyers

For Buyers, this is the last 3-6 months to get value. Across the market there is value, buy now. The market will shift on you quicker than you think by middle of next year given all we’ve shared here. We highly recommend as a Buyer to buy now and refinance late next year.