Q4 2023 Austin Real Estate Market Update

March 25 2024 – 3 Minute Read

The Morshed Group Q4 2023 Housing Market Report

What happened in Q4 of 2023

- Market Bottoming Out: After a decline in prices starting mid-2022, the market stabilized in Q4 2023, ending the year with 7-8% depreciation. No further depreciation was observed leading into January 2024, aligning with our Q2 predictions.

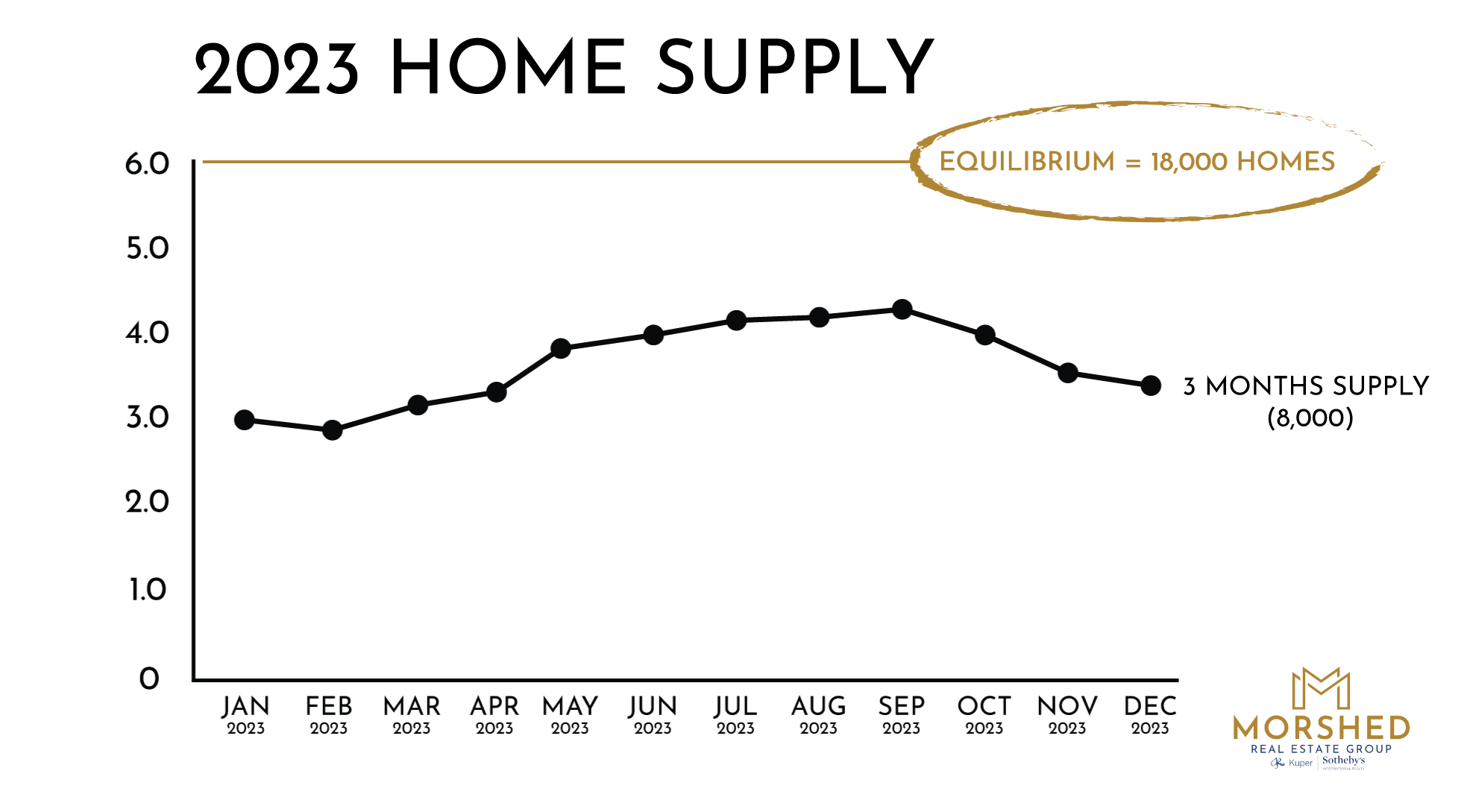

- Supply Decrease: The housing supply dropped from 4 months in Q3 to 3 months by the end of Q4, indicating the market’s bottoming out. While the higher-end market saw a supply increase, the overall market remains undersupplied.

- Interest Rate Impact: A decrease in interest rates in December contributed to a decrease in housing supply from 11,000 to 8,000 homes, alongside a notable uptick in market activity. This was supported by the addition of over 30,000 jobs and a low unemployment rate of 3.5%.

Real-World Examples

- A unique new construction in the Deep Eddy/Tarrytown area, initially listed at $3M, dropped to $2.7M, showing slow traction despite the price adjustment.

- Our listing in Circle C, updated under our management, sold within a week at $700k, highlighting the market’s responsiveness to well-positioned properties.

Looking Ahead to 2024

- Q1 Activity: An increase in buyer activity and pending contracts in January indicates a robust start to 2024, with a general acceptance of higher interest rates as the new norm.

- Market Forecast: Anticipating a single rate drop that could catalyze market momentum, 2024 is poised for appreciation. With the supply remaining at 3 months and a strong job market, we expect 4-6% appreciation in the latter half of 2024.

Advice for Sellers and Buyers

- Sellers: The optimal listing period is post-June 2024. However, those looking to upgrade should consider selling now to leverage before the anticipated price appreciation.

- Buyers: Despite past peak conditions for bargains, buying now is advisable to avoid decreased negotiability and increased competition expected by mid-2024.