What happened in Q2 of 2024

Q2 saw a continued rise in inventory within higher-end price bands and concurrently seeing a leveling off in supply within entry level price bands. Additionally, the rate of contract fallout spiked to 40% across the market, a 20 year high. The silver lining is the market hasn’t experienced near the level of depreciation of 2022 or 2023. Currently values are down 3% through June, signaling a bottoming in spite of rising inventory.

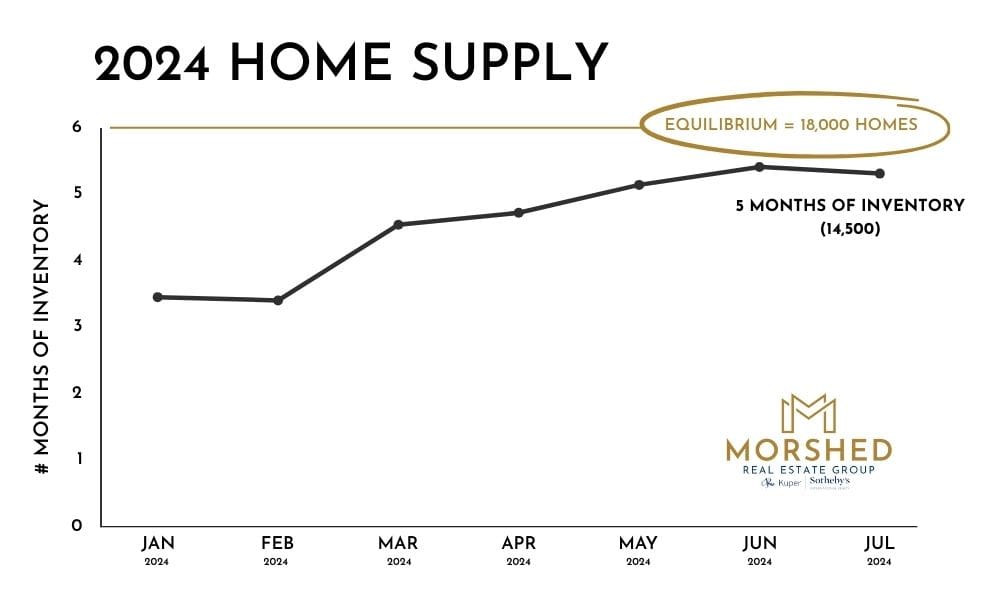

Supply of housing rose to 5 months overall at the end of Q2. Per above, it rose to 9 months above $1.5M and in the entry level range of $500k it held steady at 5 months underscoring Austin’s market has bottomed. Note, At 5 months supply market wide, we are in a real estate market environment that is still undersupplied technically. For context, a 6-month supply (or about 18,000 homes available) is an equilibrium market between Buyer and Seller demand and we would normally see 4-6% annually in price rises. At 5 months supply, there are about 14k homes on the market.

Additionally, unemployment continued to hold strong at 4%. Considering layoffs that have occurred across Austin between 2023 and 2024, this has propped up the real estate market from falling further. Currently job growth is projecting to 20k jobs for 2024. While that is lower than the 25k-30k jobs typically needed to see a balanced 6 months supply of housing in Austin, with election year and recession concerns hovering nationwide, those aren’t as bad as the media is depicting coming off many years of incredible job growth.

Currently and where it’s going

Austin’s market is likely to bump along this bottom we’ve been in most of the years till interest rates drop. In Q3, Buyer activity and transactions are up compared to 2023. However Buyers are still being very selective as they wait out interest rate drops, watching impact of local layoffs by big tech players and weighing election uncertainty. Sensitivity is high in the market underscored by the 40% fallout on contracts. Notably however properties priced below market value especially if they are turnkey are moving briskly.

Additionally, Austin continues to rank highly in the nation by respected publications (further helping to stabilize the market) such as Best City To Start a Business, Top 10 in Best Places to Live and #1 for Growth. These are good signs for the market moving in a different direction in the not too distant future.

With the Fed gating interest rate reductions and local layoffs happening, the slow market pivot for 2024 we had forecasted previously is likely not in the cards. Should a national recession still materialize, we feel Austin’s market worsens an 5-7% further in 2024. Conversely, if recession doesn’t occur, we actually think the market pivot that should have happened this year starts next year and values for the rest of year hold steady or soften a few more percentage points. Austin has taken a 30% depreciation hit since mid 2022 so we feel the worst has been baked in. And notably, for 6 consecutive months List to Sales Price ratio has held at 95% or better, up from 90% in beginning of 2023

For Sellers

For Sellers, you’re going to feel the pain of value seekers till rates lower. To sell you’ll have to leave equity on the table. Homes that are fully turnkey with pricing that sets it apart from the competition is what will sell. However the market is bottoming and relief is coming. Buyers will be re-entering as rate drops happen in Q3 and Q4. However, be prepared to negotiate even at market value.

For Buyers

For Buyers, this is the last 3-4 months to pick up most value. Negotiability is down slightly compared to 2023 and will decrease further as Buyers begin to re-enter the market when rates drop. The market will shift on you quicker than you think and after a 2nd rate drop next year we’ll see Austin shifting back into appreciation.