Austin Real Estate Market Update Q4 2015

January 8, 2016 – 5 Minute Read

For those of you that used to receive my newsletters in the past, I hope this brings “a welcome back” smile. For those receiving this for the first time I hope you find immense value and education in it. With final stats recently in for 2o15, let’s dive in.

2015 was indeed an interesting year in the Austin real estate market. Headlines generally screamed of an undersupplied hot market along with price rises. Multiple offers leading to above full-price scenarios were consistent.

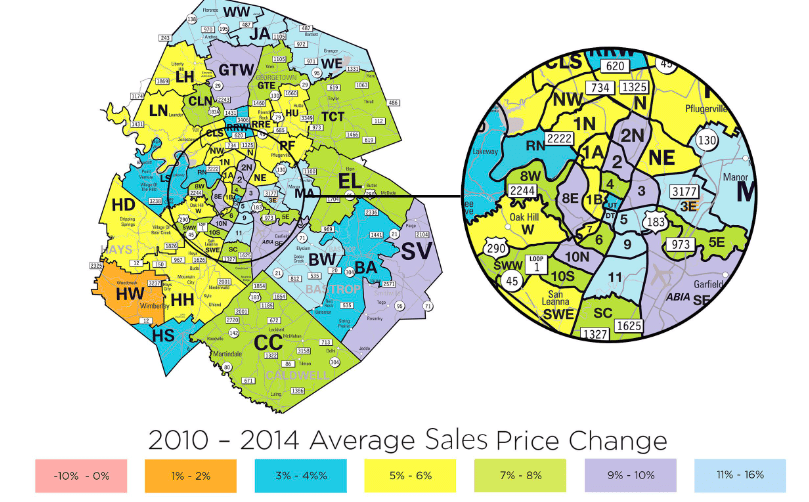

The price appreciation (in a strong wave upwards since 2011) has been led by incredible economic fundamentals. Employment growth, the lead indicator of our real estate market has seen 4%+ job growth rates culminating in 30%+ market-wide average appreciation on real estate here since 2011 as depicted below on annualize basis.

For those of you that used to receive my newsletters in the past, I hope this brings “a welcome back” smile. For those receiving this for the first time I hope you find immense value and education in it. With final stats recently in for 2o15, let’s dive in.

2015 was indeed an interesting year in the Austin real estate market. Headlines generally screamed of an undersupplied hot market along with price rises. Multiple offers leading to above full-price scenarios were consistent.

The price appreciation (in a strong wave upwards since 2011) has been led by incredible economic fundamentals. Employment growth, the lead indicator of our real estate market has seen 4%+ job growth rates culminating in 30%+ market-wide average appreciation on real estate here since 2011 as depicted below on annualize basis.

As most of you have heard me share, a 6 mth supply of housing is considered an equilibrium market. At year-end 2015, we were at 3.14 mths supply following the general trend of 2-3 mths since 2012. However, some dissonance also showed up in 2015. Breaking down price-bands:

As most of you have heard me share, a 6 mth supply of housing is considered an equilibrium market. At year-end 2015, we were at 3.14 mths supply following the general trend of 2-3 mths since 2012. However, some dissonance also showed up in 2015. Breaking down price-bands:

- Below $600k it’s been 3.14 mths or lower. $600k-$1M is at 7 mths. $1M+ is at 10+ mths.

- Year-over, there is a 20% rise in inventory above $500k.

- So the real story is below $600k we were indeed undersupplied while above $600k we were actually oversupplied.

- Above $600k has peaked. Prices may overall hold steady in 2016 but unlikely to see price appreciation.