What Happened in the Residential Housing Market Q3 of 2025

During Q3, per our forecasts since Q3 2024, the market sent it’s clearest signals of hitting bottom in spite of tariff uncertainty, the AI movement and right-sizing collectively slowing job growth, which remains the main engine for Austin’s real estate market.

September and October saw notable pickup in the market. Combined with a cumulative of 4 quarters totaling less than 3-4% depreciation and an 8% uptick in pendings we’re confident the local market has found it’s bottom. An additional important indicator – a clear uptick in luxury listings contracting including speculative custom level construction that had been sitting for 6-12 months.

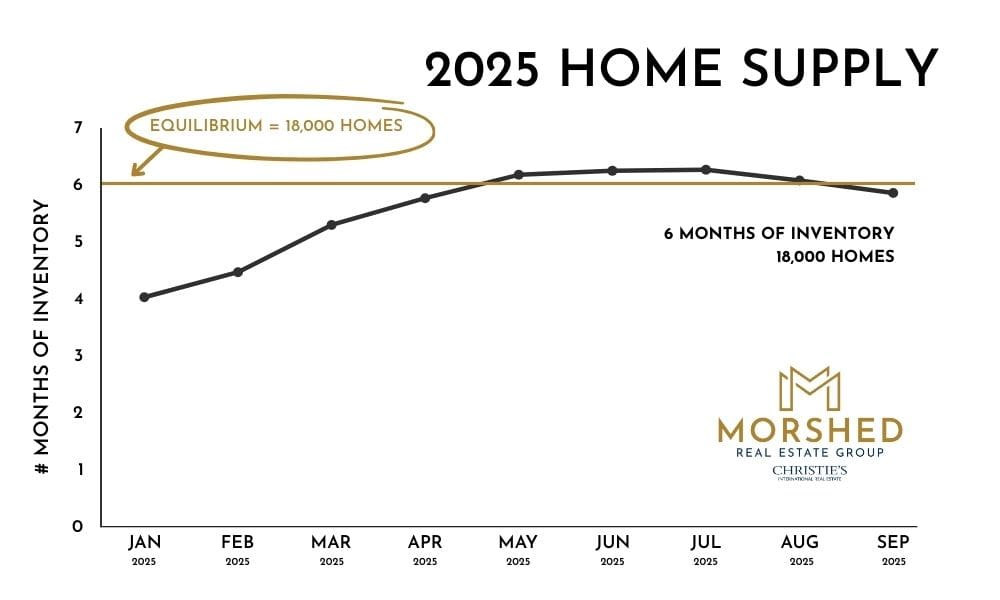

Averaged across all price bands and areas, supply did uptick to 6 months in Q3 and the high-end remains oversupplied while edging down from previous highs of 10+ months. For context, a 6-month supply (or about 18,000 homes available) is an equilibrium market between Buyer and Seller demand and we would normally see 4-6% annually in price rises which is not happening this year due to tepid job growth.

Unemployment still held at 3.5%, great numbers though hiring has remained very stagnant coupled with layoffs happening around Austin’s tech sector through Q3. We believe there is still some pain coming here but with Austin being one of the top equity rich households markets in the country combined with a less than 5% foreclosure rate, we see still see this as a bottom vs worsening.

Currently and Where It’s Going

Q4 so far has shown the same level of activity uptick as Q3. Buyers that were on sidelines are contracting as they’re sensing the bottom of the market. Interest rates dropping .5% has helped that same conversation psychologically.

We expect steady activity to close out the year outperforming Q1-Q2 while mostly moving horizontal due to tepid job growth in spite of a recent #1 ranking for future economic growth by Coworking Cafe. Tech growth has been at zero to slightly negative all year and given it’s the main economic engine for Austin today, we don’t see housing market shifting upwards till back half of 2026. Where there was a possibility of slight appreciation towards Q4, it’s zero at this point.

For Sellers

There is more traffic in the market today, but Sellers must stand out as a clear value relative to competing listings. The homes selling today are typically priced 3 to 5 percent below market. If you are unable to price within that range, waiting until late 2026 or early 2027 may be the better strategy.

For Buyers

For Buyers, we still believe this is the bottom. Buy now and in the next 3 months. When there is confidence/clarity that the market has indeed bottomed over the next 3 months, it’ll mean less negotiability for you.

Closing Thoughts

If you would like a deeper breakdown of how these trends affect your neighborhood or investment strategy, our team is here to help you evaluate timing, pricing, and positioning as Austin heads into 2026.