What happened in Q4 of 2024

Q4 saw the true bottoming of the market in every price band. While the entry level and mid-level price bands had bottomed in Q3, clear signals flashed that Austin’s high-end price band also found it’s bottom. Notably, activity in November and December across ALL price bands were actually higher than any time through 2024. This seldom happens in the last quarter of any year, especially in a soft market year. Pendings jumped 16% and supply dropped from 12k homes to 8500 homes across Austin.

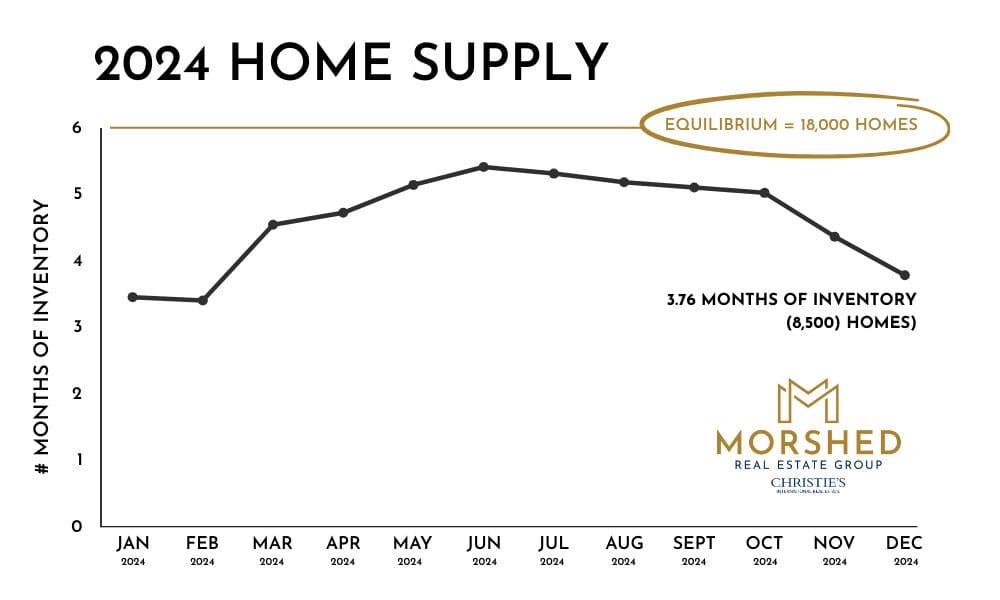

Tied to the above #’s supply banded down through Q4 from 5.9 months in October to 3.76 months by end of December which is a big shift in real estate terms. Notably, up to $1.5M, supply has maintained at 5 months or less. This is another great lead indicator that the market has bottomed. Additionally, the supply above $1.5M moved from 11 months to 8.5.

For context, a 6-month supply (or about 18,000 homes available) is an equilibrium market between Buyer and Seller demand and we would normally see 4-6% annually in price rises. At 5 months supply, there are about 14k homes on the market.

This all occurred in Q4 on the heels of elections ending yet rates remaining high, another strong signal the market in Austin bottomed. Additionally, Austin’s economy stabilized with very healthy unemployment numbers. Job growth ended at 23k jobs. While that is lower than the 25k-30k jobs typically needed to see a balanced 6 months supply of housing in Austin, the fact there was still some growth in a tough environment sets the stage for healthier 2025.

Currently and where it’s going

Austin’s market is likely to bump along the bottom until job growth picks up in Q2 and interest rates drop. We expect to see the market shift to an appreciating market in the 2nd half of the year. Indeed, rate drops are a question mark in the pending tariff/inflation environment. Buyers however are (and will remain) much more active in 2025 in spite of this, spurred by confidence in the local economy and experiencing major price drops are coming to an end. Strong international growth, in-migration picking up again and rankings such as Top 10 Tech Hub only help.

For Sellers

For Sellers, 2024 will be better than the last 2 years. Buyers will start making decisions faster and competition for your property will slowly increase. Homes that are fully turnkey with pricing that sets it apart from the competition will be important. You’ll still have to negotiate to sell still but on average 5% or less from your market value, a marked improvement.

For Buyers

For Buyers, this is the last 3-4 months to pick up most value as market stabilizes and the appreciation upcycle starts again in Austin. Negotiability is banding down over the next few months and we expect there to be 2-4% appreciation in the back part of 2024. Buy now so you can pick up 6-8% appreciation starting next year depending on area.