The Morshed Group Q2 2023 Housing Market Report

What happened in Q2 of 2023

Q2 was slow-moving and languid as a real estate market mirroring record-breaking heat culminating in market cap loss, slight uptick in inventory, and inching very close towards the soft landing we’ve been forecasting.

The market saw 3% depreciation across Austin bringing us to 6-7% depreciation for the year through the end of June, in line with our forecast. The big takeaway – Austin’s market showed resilience at these numbers, they are a lot less than most national experts predicted in beginning of 2023

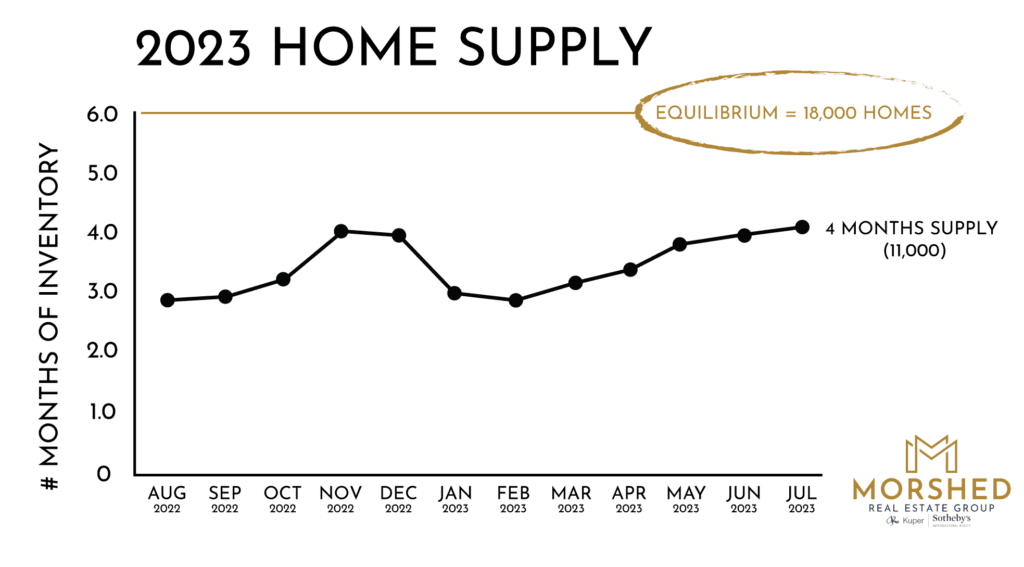

Supply of housing landed at 4 months up from 3 months in Q1. At 4 months supply we are in a real estate market environment that is still undersupplied. For context, a 6-month supply (or about 18,000 homes available), is an equilibrium market between Buyer and Seller demand and we would normally see 4-6% annually in price rises. At 4 months supply, there are about 11k homes on the market, so still well below 18k homes or above.

The economy and job market in Austin proved it could weather the economic storms of the last 12 months. This was an important benchmark. Job layoffs have been lower than expected, we’ve remained Top 5 nationally for job growth in a down year, and unemployment has been low at 3.8%. Buyers felt the pain around interest rates continuing to spiral up to 7-7.5%, the highest in over 20 years! This simply shut down activity in Q2 leading to depreciation when normally we’d see appreciation at 4 months supply.

Currently and where it’s going

Buyer sentiment has been “lets move forward because market seems like it’s not crashing and we can’t wait forever, BUT lets only do it if it’s a great value given these high interest rates.” So the only places selling are ones priced clearly as a value compared to the competition without having to be a steal. Also, creative deals are making a comeback – assumable loans that have lower rates, owner financing etc given the higher rate environment.

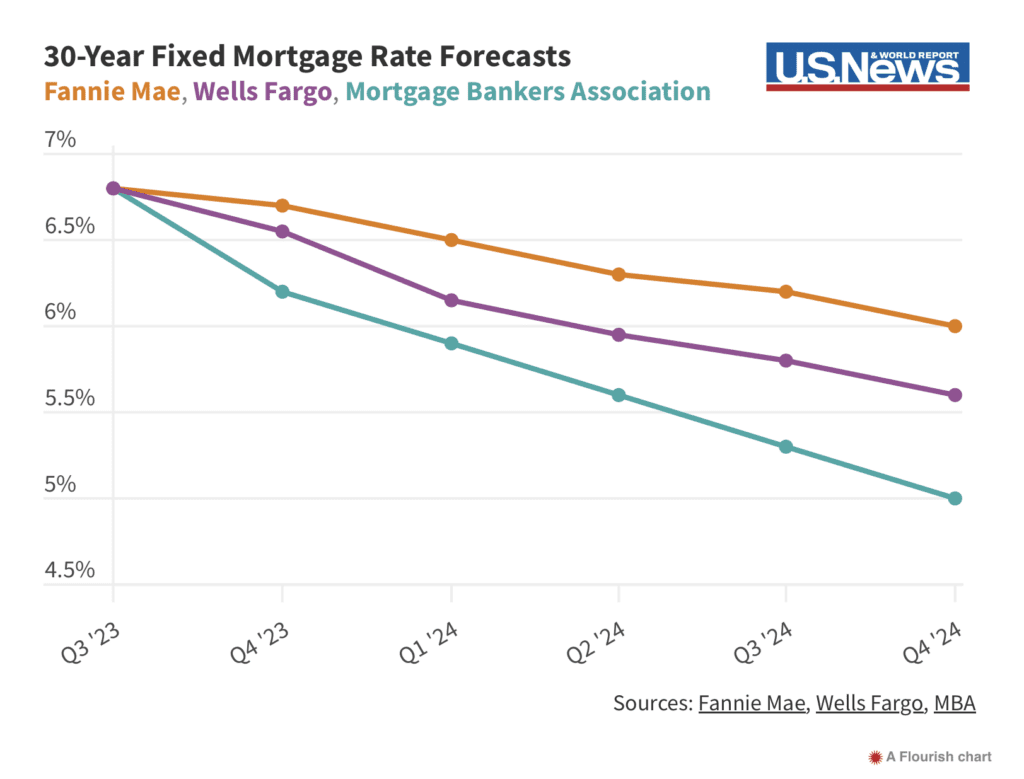

We’ve hit bottom and we feel prices may drop 1-3% more if that, so we’re pretty much arrived at the soft landing we forecasted. We feel activity will generally pick up moving forward but Buyers will still look for value to be compelled to buy. Interest rates are the last domino to fall and they will. We’ve been forecasting rates will start moving down somewhere in Q4. And it looks like we’re getting support on that forecast per this chart. Three major Lending Institutions forecasting 5-6% rates in 2024. We feel the market is poised for appreciation heading into 2024 given lower supply and stable job market as well as steady population growth.

For Sellers

For Sellers, you’re going to feel the pain of value seekers till rates lower so pricing and separation from the competition is paramount. Homes that are fully turnkey with pricing that sets it apart from the competition is what it’ll take. Otherwise price will have to be aggressive. If you’re not willing to do that, you’re better off waiting till next year when rates start banding down

For Buyers

For Buyers, this is likely your last window to find value. Between now and December, Buyer confidence in our market will increase as they’ll see prices aren’t aggressively dropping. Once they see rate movement downward things will pick up more. I highly recommend as a Buyer to buy now and refinance late next year. Remember. you marry your home, not the rate.